So, you've closed your loan. Congratulations!

We are excited to welcome you into the CEF family.

On this page, you will find information on all you need to know throughout the life of your loan like: how to make a payment, what to do if you need to make a change to your account, how to utilize our free business coaching services via our Business Acceleration Services (BAS) team, and more.

Information On Servicing Your Loan

Below are common situations that you may encounter over the life of your loan.

Changes to Your Account

- Can I change the bank account used to make payments or my address on file?

- Yes! You can always update your information with us to change the account from which we pull your payments.

- If you've had a change in business ownership or guarantor, if you have a change in your business or personal address, or if you sold or refinanced your house or car that we have a lien on, we need to update our files to reflect those changes.

- You can always contact us about payments at servicing@coloradoenterprisefund.org

Making Payments

Having trouble making payments? Need to modify your payment schedule? Contact servicing @

Requesting Payoff Statements

If you've paif off your loan and need to request your payoff statement, please contact servicing@

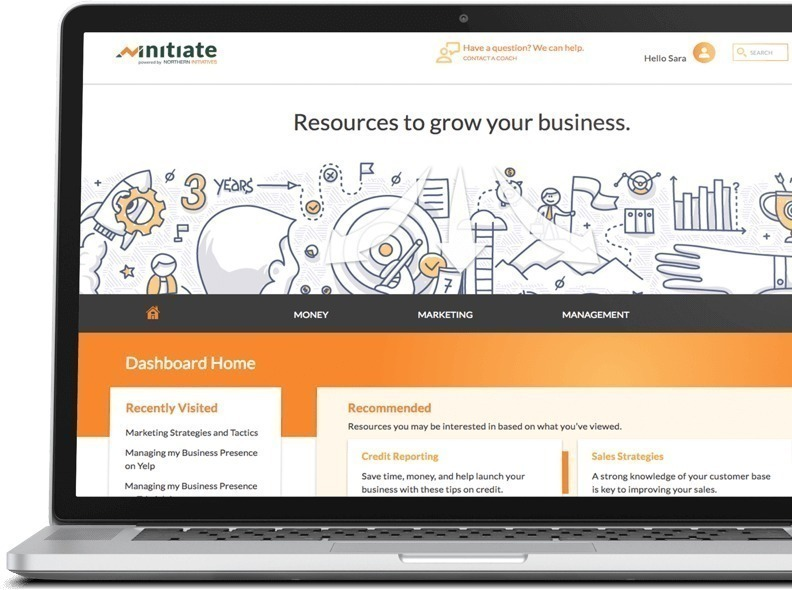

As a CEF customer, you can schedule one-on-one sessions with our Business Acceleration Services (BAS) Advisors, plus access an online library of free, downloadable workbooks and more, for the life of your loan.

[schedule a meeting]

Business Planning

Sales & Marketing

Finance & Accounting

Cash Flow & Profitability

Human Resources & Legal

Technology & Business Software

Meeting with our Business Acceleration Services (BAS) team

Our in-house team of success advisors are here to help you develop good habits, the right structure, and the confidence and knowledge to grow – all free of charge.

These advisors are experts in their fields and will help you to reduce small business risk and support your long-term success through personalized, one-on-one business advising and coaching.

Take your initial business assessment with your advisor by scheduling a meeting below. They will then work with you to build a customized road map of the next steps to move your business forward and meet with you, over the duration of your loan, for continued learning and growth.