We want to learn about you!

CEF has funded 9,500+ small businesses in Colorado

See if you are ready to apply for financing to start or grow your business

Apply NowWhat STAGE is my business at?

Early Stages - Developing Business Concept

- Developing idea for a business

- No business plan or projections

- Need to calculate start-up costs

- Need to do market research regarding market size & demographics

- Have not registered a business

- No established sales methods

- Lack of potential vendors

- Unclear path for production processes

Need Some Help Before Applying for Loan

- Concept researched and planned, but seeking feedback

- Business plan started, needs review

- Financial plan underway; needs clearer structure

- Have a business model—seeking insight into what works for others

- Would like to speak to a business expert to determine if you are "loan ready"

Ready to Apply

- Have all the documents listed on the right ready to upload in the application.

- CEF will run a hard credit report. This means it could affect your credit rating.

- Ready to pay a non-refundable $25 application fee.

- You do not have to complete the application in one session. You can save and come back to finish later.

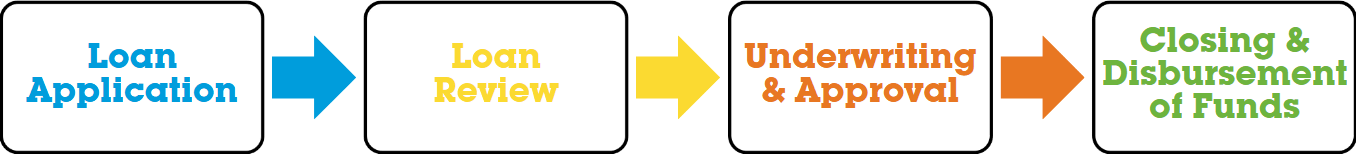

Stages of the Journey

Eligibility:

- Colorado-based company

- Must be 18 years or older.

- CEF will NOT provide loans for certain types of businesses such as marijuana, e-cigarettes, gambling, adult entertainment, pyramid, or illegal activities. CEF does NOT provide loans for residential real estate.

- Must have 10% of loan amount in your bank account at time of closing.

- Loans over $75K may require a pledge of your home as collateral if you are a homeowner.

- We will review your application and let you know if additional information is needed to determine eligibility.

Documents to Apply - Startup

- Business Plan (including financial projections & startup budget)

- Cash Projection

- Business Insurance showing content coverage(if applicable)

- EIN# Letter

- Lease Agreement or Letter of Intent (if applicable)

- Proof of personal investment

- Bank Statements (personal, 3 months)

- Driver License/State Issued ID & Citizenship/Residency docs

- Personal Financial Statement

- Proof of Income (paystub or draw ledger)

- Personal Tax Returns (2 years)

- Debt Service Worksheet

- Statement of Ownership

Further documentation may be required depending on collateral, size of loan, and quality of the documents provided.

Documents to Apply - Existing Businesses

- Bank statements ( personal & business) 3 months

- Cash Projection

- Balance Sheet (existing business)

- Business Insurance Showing Coverage (if applicable)

- Lease Agreement (if applicable)

- Profit & Loss

- Tax Returns (personal & business) 2 yrs

- Driver License/State Issued ID & Citzenship/Residency docs

- Personal Financial Statement

- Proof of Income (paystub or draw ledger)

- Debt Service Worksheet

- Statement of Ownership

Further documentation may be required depending on collateral, size of loan, and quality of the documents provided.

Contact Us

Please Enter Your Email Address to Download the Toolkit

Search Our Site

Subscribe to Our Newsletter

|

|

Thank you for Signing Up |