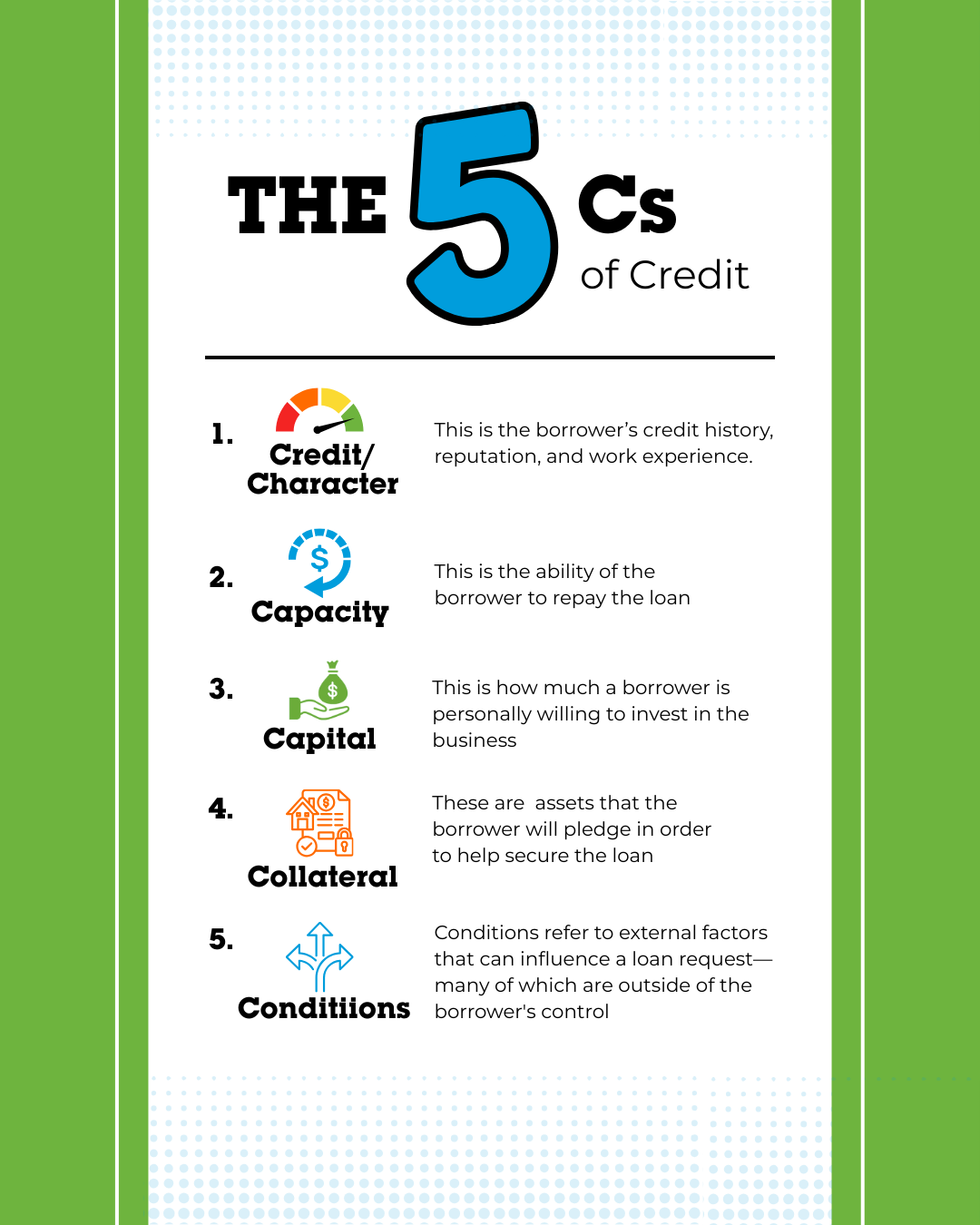

The 5 Cs of Credit and Why They Matter

There are mainly 5 Cs of Credit that financial institutions, including Community Development Financial Institutions (CDFIs) use to evaluate a loan request. This allows a lender to assess your credit risk and determine your ability to repay the loan. While all are important, some are given more weight than others depending on the lender.

-

Credit/Character: This is the borrower’s credit history, reputation, and work experience. Traditional banks will typically put more emphasis on the credit report, as this track record shows how you have managed credit and payments in the past. Credit reports usually give you a number between 300-850. This is also referred to as a “FICO score.” The higher the number, the better. Making sure your credit report is accurate helps to keep your credit score in good shape. The main three credit reporting agencies are Equifax, TransUnion, and Experian. If you have a lower FICO score, be able to explain what contributed to the challenges at that time, such as medical bills, being laid off, divorce, etc.

While past credit is important, CEF also values the borrower’s work experience. If a borrower is opening a plumbing business and is a master plumber with 10 years experience, this provides a greater comfort level than someone opening a plumbing business who has only been an apprentice for 6 months. If you don’t have “direct” experience, be prepared to speak to “indirect” experience. An example is that you have managed a team before, so you have experience with hiring, budgeting, etc. Therefore, the lender is more comfortable with your ability to run an operation.

-

Capacity: This is the ability of the borrower to repay the loan. At CEF, we will look to see if the existing financials or the financial projections are able to support the loan.

-

Capital: This is how much a borrower is personally willing to invest in the business. The more a borrower is willing to contribute, the less risk the lender will need to take. At CEF, for a new business, generally, a minimum of 10% is required for the loan.

-

Collateral: These are assets that the borrower will pledge in order to help secure the loan. It’s important the customer understands the value of the assets to be pledged. Generally, these are business assets, vehicles, or real estate. The more collateral you provide, the better a lender will feel that you are going to pay back the loan. However, a lender must assess the value of that collateral too. Equity in a home is generally considered more valuable than an old car.

-

Conditions: Conditions refer to external factors that can influence a loan request—many of which are outside of the borrower's control. These may include environmental or economic issues, the overall health and trends of the industry, and larger-scale influences like geopolitical risks or shifts in regulatory environments. Each lender evaluates loan applications differently. At Colorado Enterprise Fund (CEF), we are a Community Development Financial Institution (CDFI), which means our lending guidelines are often more flexible than those of traditional financial institutions. This doesn’t mean we operate as a charity, or that every applicant will qualify for a business loan. What it does mean is that we are mission-driven, and we work hard to make a meaningful impact on Colorado’s small businesses and communities by providing access to capital that might not be available elsewhere.

Learn more about CEF loans by visiting www.coloradoenterprisefund.org/loans

Written by:

Alan Ramirez

Director of Strategic Lending

Colorado Enterprise Fund