Beware the Hidden Dangers of POS Merchant Cash Advances

Need cash fast for your business? A merchant cash advance (MCA) from your Point-of-Sale (POS) provider may seem like an easy & quick solution- but it could lead to an overwhelming cycle of debt that’s hard to escape.

MCAs are becoming more popular, but many small business owners only realize the risks after it’s too late. These cash advances are often considered “predatory” or “payday” loans, but in reality, they are not loans, they are cash advances and not subject to truth in lending requirements. MCAs provide money based on future credit/debit card sales. Yes, they are quick and easy with minimal documentation, but are difficult to pay back and lack the regulatory oversight that governs credit card issuers or traditional lenders since they are not true loans.

How Merchant Cash Advances Work and Why They’re Risky

With an MCA, repayment is taken directly from your daily credit/debit card sales. Typically, the lender deducts 10% to 20% of your revenue—before you even see it. On the surface, this might seem manageable, especially for a short-term loan. However, these daily deductions can severely impact your cash flow, particularly during slower sales periods.

This repayment structure often leads to a dangerous cycle:

-

Cash Flow Strain: The POS/MCA provider collects their payment first, potentially leaving you without enough funds to cover payroll, vendor payments, or other operating expenses.

-

Debt Snowball: Struggling to make ends meet, many small business owners take out additional loans to cover shortfalls, creating a snowball effect of mounting debt to stay afloat.

-

Limited Financing Options: When cash flow is tight and profitability suffers, traditional lenders may be hesitant to offer refinancing or more affordable loan options, leaving you stuck in a high-cost borrowing loop.

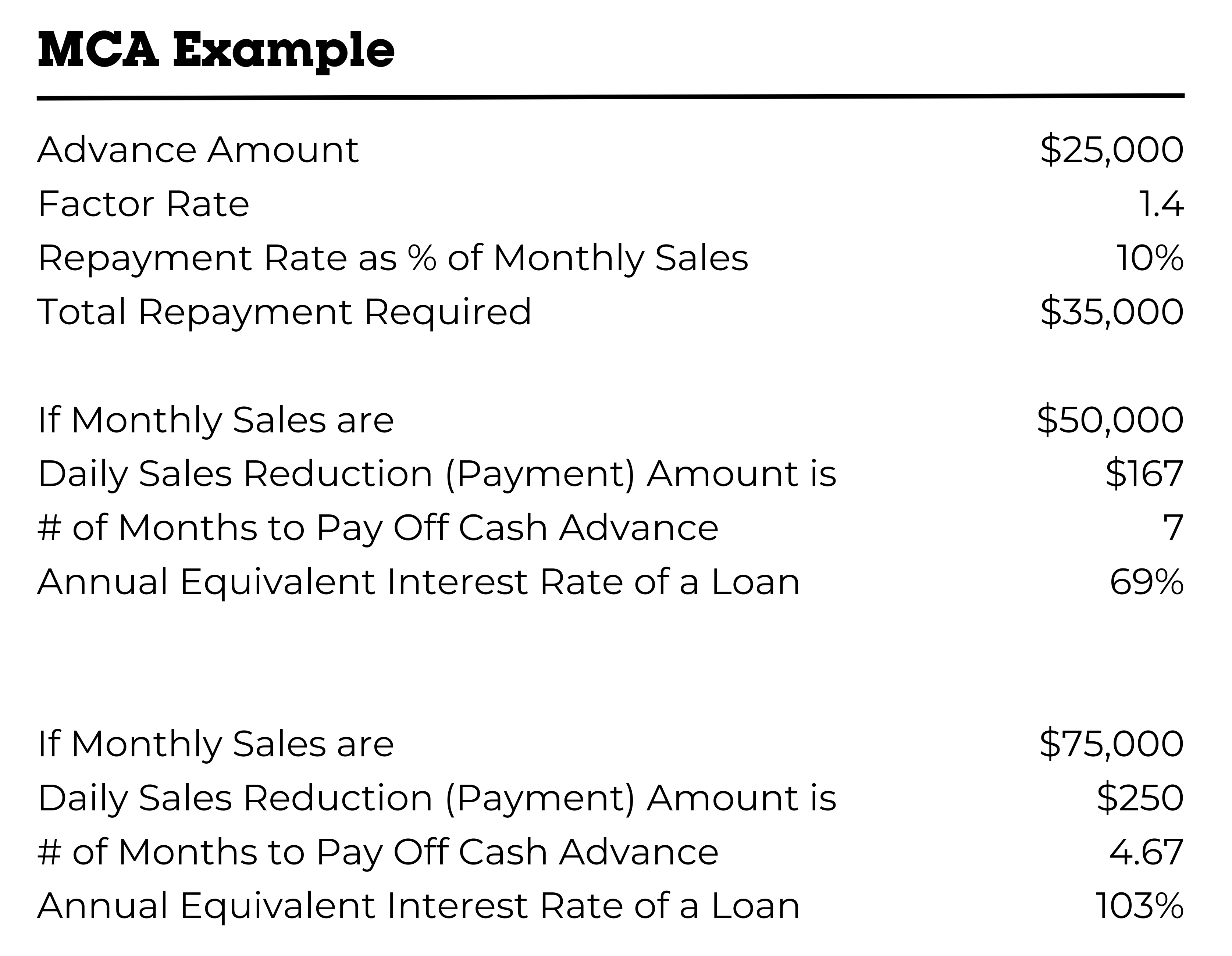

Example:

-

POS/MCA company determines a factor rate, basically the interest rate. When converted to an annual percentage rate (APR), this can exceed 100%. The factor rate may seem low at first, but it’s applied to the full loan amount, not just the remaining balance, so this is why the APR can well exceed 100%.

How many small businesses have a net profit margin so large that they can afford to give away 10% of it every day, even temporarily?

The Long-Term Effect of MCAs

POS/MCA financing is not just expensive, it can also create an unsustainable operating expense. Unlike a traditional loan with fixed interest rates, MCA repayment rates and terms can quickly deplete your profitability and threaten the sustainability of your business in the long run.

What You Can Do Instead

At Colorado Enterprise Fund, we’ve seen a growing number of businesses seeking to refinance their POS/MCA debt. If you have already fallen into this trap, CEF may be able to help. We have helped several small business owners restructure costly MCAs, preserving their businesses, protecting their revenue, and safeguarding the jobs they provide.

Advantages of a loan from CEF are:

-

Loans structured to work with your business cash flow (net sales)

-

Fixed monthly payment rate so you know exactly what you need to pay each month.

-

Longer repayment terms

-

No prepayment fee if you pay off loan early

-

Terms are clear and understandable

While MCAs may provide quick funds, the risks often outweigh the benefits and can impact your business’s financial health. Whether you choose a loan from CEF or another traditional lender, taking the time to pursue traditional financing rather than a merchant cash advance will likely provide greater long-term benefits for your business.

Written by:

Becky Fuller

Senior Credit Analyst

Colorado Enterprise Fund